Difficulty totally free The ideal plan if you're time poor, or you simply do not like handling unlimited car tasks. Simply the fundamentals, this plan obtains you behind the wheel of your next car, fast and very easy. In case of Overdraft account-- OD will be enabled just wherever sustained by company for one year as well as renewed/reviewed on satisfying efficiency.

- It's as close as you will ever reach 'having your cake as well as eating it as well', as for housing finances go.

- Given that to get a flexi personal car loan you need to be a pre-approved consumer, the cash will certainly be attributed to that identical account you hold with the bank or lending institution.

- The whole approved amount is disbursed to the savings account on car loan approval.

- Simply the fundamentals, this bundle obtains you behind the wheel of your following car, fast and easy.

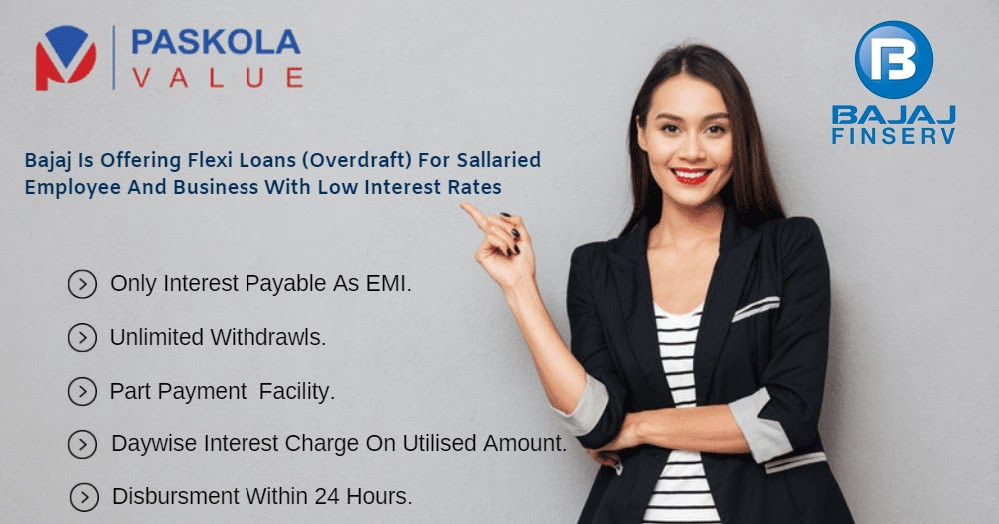

- When you look for Bajaj Finserv Personal car loan online, you obtain instantaneous approval within 5 mins.

You save money on passion prices as interest is spent for used financing amount only. You can additionally take pleasure in 4 years moratorium on primary repayment. Bajaj Finserv is a customer-friendly lender and also prolongs optimum adaptability to the customer. A host of Personal Loan offers are developed to match different kinds of customer accounts such as employed, freelance or professionals. The consumers obtain choice to choose Term Finance, Flexi Term Car Loan or Flexi Crossbreed Funding for repayment simplicity. Crossbreed Flexi Finance-- When it comes to a hybrid Flexi loan, the consumer gets the finance for a dealt with restriction.

Info brought at this web site is not as well as must not be interpreted as a deal or solicitation or invite to borrow or offer. The Company does not take on any type of responsibility relative to the accuracy of the content, info and also computations. This is a complimentary service and no charges are payable by the customer to MyLoanCare.

Premium Posts

You can go with Flexi Car loan facility and choose flexible payment and tone ranging from 24 months to 60 months. The approval is immediate, and disbursal is assured within 24 hours of documents confirmation. The interest rate charged on the term financings of FlexiLoans is really affordable and does place any type of burden on the consumers. FlexiLoans fees interest beginning with 1% each month of the finance quantity. The last interest rate will depend upon the amount of financing, period, credit account of the customer, and so on.

FlexiLoans supplies versatile repayment choices with regular or regular monthly EMI payments and interest is billed starting from 1% each month of the car loan amount. Flexi personal funding is a good alternative as you can handle your finances with adaptability and also some lending institutions additionally use immediate flexi fundings. Flexi financing features advantages like reduced EMI's, adaptable settlement of lending partially, loan amount paid out promptly, calls for very little documentation etc

Accessibility Of Funds Stays Whatsoever Times

A GST price of 18% will apply on banking product and services from 01 July, 2017. Sample finance arrangement makes mention of a Maintenance Fee for a flexi lending. As I understand, the fee is an outright fee and not a percentage of your finance amount.

The Firm might receive commission from lenders for services supplied to them. The amount taken out throughout the lending tenure have to be within the limit of the amount pre-approved by the loan provider. What differentiates a flexi car loan from any kind of various other sort of loan is the way payments function.

This function makes BFL Personal Loan incredibly simple and hassle-free for the consumers. flexiloans valuation Allow's go over types of Individual Car loans by Bajaj Finserv on the basis of payment ease and on the basis of end use the lending. Apply for a loan from throughout India simply by addressing some questions on the website or application.

Our dedicated as well as best-in-class customer support will certainly go above and beyond to sustain you on every action of your debt journey. While a normal personal financing has a collection settlement schedule and the rate of interest could be lower, selecting a flexi individual funding does have its advantages. The firm is a signed up Non Banking Financial Company that provides consumers with immediate financings with versatile payment periods. The details of the term lending for the local business are discussed listed below.

Amongst the various kinds of car loans available on the market, individual financings and also hybrid Flexi lendings are the two most usual ones widely used by most lenders. For a regular personal financing, the tone is a set payment duration throughout which you must settle your charges in EMIs. Several financial institutions and also NBFCs supply flexible tenure on finances, the entire loan amount and interest gets split across the entire tenor as well as the exact same amount in EMIs. Besides, the rate of interest is charged on the whole loan quantity. Get in touch with the financial institution you have a relationship and check the eligibility criteria of the flexi individual funding available.